Insider Update, Oct 2024 Edition!

Version 0.1 of Babbage Insight is ready, and we are selling it as a service.

TL;DR

If you (or someone you know) wants to explore it, please 📩 let us know via email, or 📞 schedule a demo with us!

Actually - here are some quick screenshots to show you what we do.

A quick "demo"

You initialise our system with the metrics you are tracking, along with SQL statements to generate them. You also need to give us some more metadata. Something like this:

A sample input config file

In a preprocessing step, our system takes your metrics, understands your data schema and then generates some auxiliary metrics.

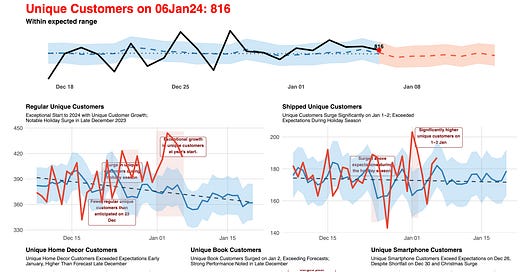

And then, at the defined frequency, the algorithm runs, finding exceptional insights in your metrics (including the auxiliary metrics). And produces reports like this:

Insights in priority order

This whole thing was automatically produced, from one simple run of a script! The first line here is the “ticker”, which shows the metric (right now we have an initial version where there is only one main metric to track - we’re fixing this very soon), put in context (too high / too low / trend / forecast / etc.).

Below that you see the key “stories”, that could be either of the main metric or any of the sub-metrics. Again this is still very early days (and you might recognise the graphs as being generated using ggplot2) but notice that we have a headline there talking about the key insights. The key regions of the data are all marked out (we need to improve our LLM game to improve these annotations, of course).

Let’s look at a report for another day:

Insights in a DIFFERENT priority order

This is a toy data set (downloaded from Kaggle) that we’re reporting here, so there isn’t that much insight in the data. But you can see that the ordering of graphs is different - because the significance of insights are different.

Here is another day’s report:

Another day, another Insight

You notice that these reports talk about what is exceptional. Soon they will also have the why (this is work in progress).

Actually - a part of the “why” has been tangentially covered already, since we have shown exceptional insights in the auxiliary metrics as well, but we are working on formalising this, and also finding other ways of explaining why some things are the way they are (using correlations, unstructured data, etc.).

What do you think about this? And once again, do you think you or someone you know can use this in your job? Give us a shout!

Selling

The weight of all these expectations

Over the last four months, we’ve been building what you see above. And in the last couple of months, we’ve started selling it.

Some of our “insights” so far from the conversations we’ve had with potential clients:

👉🏽 When we say “AI data analyst”, people immediately think “copilot” / “Q&A system”. We have been spending more time than we want to telling people that this is NOT what we are building. I guess we need to change our positioning. Or maybe now that our demo is ready, lead with it.

👉🏽 We are explicitly NOT doing free POCs - if the customer is not spending money, it doesn’t really prove any concept to us. This no doubt introduces friction in the sales process (and some of our conversations have ended because of this), but this is necessary so we don’t unnecessarily slip later on.

👉🏽 We had initially thought we’ll target companies of annual revenues of ~$10-100M range. Based on our conversations over the last couple of months, we believe that our ideal customer is likely to be larger - of the $100-250M range (₹500-5000Cr range for Indian companies). So we need to rethink our sales strategy (assuming we had already thought of it).

👉🏽 In general, we’ll probably be better off selling to companies with smaller data teams.

Any insights on navigating the above would be strongly appreciated!

Thank You

Happy Deepavali / Halloween to those who are celebrating!

Looking forward to working with you all,

Karthik & Manu

Co-Founders

Karthik Shashidhar (LinkedIn, Email) is Co-Founder at Babbage Insight. He is an award-winning data science leader, having performed multiple roles across data science and analytics over the last dozen years. Most recently, he was Senior Vice President of Data at Delhivery (India’s largest technology-first logistics company). Karthik has written a book on market design, written a column for Mint (India’s premier business newspaper) and taught at IIM Bangalore. He holds a Bachelor’s degree in Computer Science and Engineering from IIT Madras, and a PGDM (equivalent to an MBA) from IIM Bangalore.

Manu Bhardwaj (LinkedIn, Email) is Co-Founder at Babbage Insight. He has 15+ years of US-based technology product leadership experience, focusing on Enterprise SaaS platforms and investment banking technology. While in Chicago, he built consumer lending+BNPL+credit card B2B2C platforms at Amount Inc. and Avant, for clients including HSBC, PNC Bank and Capital One. While in New York City, he led risk management and software development programs at Deutsche Bank, JPMorganChase and Bloomberg LP. He holds a Bachelor’s degree in Computer Science and Engineering from PESIT Bangalore, and a PGDM (equivalent to an MBA) from IIM Bangalore.